Why is the truth so difficult? American journalist and social-political activist Gloria Steinem once said, “The truth will set you free, but first it will piss you off.”

And that captures the heart of it. We all want the truth, but we also want the truth to be our truth. If it isn’t our truth, we are in a bit of a pickle. Subjectivity and objectivity, assuming we even know what they are, don’t mix well. The truth is that truth is fragmentary. We often see pieces of truth, but those pieces still need to be arranged in the jigsaw puzzle of life.

I often think the truth is like a muscle: you need to exercise the search for it, otherwise it weakens.

In that great movie A Few Good Men, Tom Cruise plays Lt. Daniel Kaffee, a military lawyer defending two US Marines charged with killing a fellow Marine at the Guantanamo Bay Naval Base in Cuba. Although Kaffee is known for seeking plea bargains, a fellow lawyer, Lt. Cdr. JoAnne Galloway (Demi Moore), convinces him that the accused marines were most likely carrying out an order from a commanding officer. Kaffee takes a risk by calling hard-bitten Col. Nathan R. Jessep (Jack Nicholson) to the stand in an effort to uncover the conspiracy.

Then follows one of the great sequences of movie scripting, culminating in Nicholson demanding to know if Cruise really wants answers. Cruise retorts, “I want the truth!”. Nicholson snaps back at him, “You can't handle the truth!” Then follows a diatribe about the soldiers who stand on the walls, with guns guarding the freedoms that people like Cruise (Kaffee - weird name, BTW) take for granted.

“You don't want the truth because deep down in places you don't talk about at parties, you want me on that wall – you need me on that wall. We use words like ‘honor, ‘code,’ ‘loyalty’ We use these words as the backbone of a life spent defending something. You use them as a punch line.”

Thumping speech. With it, Cruise lures Nicholson into admitting that he ordered “Code Red", and the two marines were sent to “discipline” the errant marine, accidentally causing his death. One of the great pieces of dialogue by screenwriter Aaron Sorkin early in his career.

The enduring legacy of the film vests in the odd verity of the phrase 'you can’t handle the truth' because, in fact, it is often hard to accept the truth or at least things we don’t want to believe. And we know this because so often, people substitute their own truth for an objective truth, often claiming in the process that there is no such thing as the objective truth, which makes it so much easier to effect the substitution.

When I look around, there is one entity that does come pretty close to telling the truth, and that is the bond market. I wish I understood the bond market better, but I know enough to sense why it's such a powerful truth-teller. First, it's huge. The global bond market is worth well over $130-trillion — bigger than the global equity market. Its size mitigates against deliberate manipulation or speculative hype, something that grips stock markets, arguably, all the time.

Second, it is a market and embodies the great advantages of markets. Participants only get rewarded for investing correctly. It's binary; you are either right or wrong. There is no hallucination or reverie available.

And unlike the equity market, it's so much more mechanical. Investing in equities is often an act of hope and expectations. In the bond market, at the time of investing, buyers of bonds know precisely what they are going to get. It's absolutely clear. As time goes on, the value of the bonds decreases and increases with interest rate expectations. Those investors are taking a punt. But at the moment of sale, for the original buyer and seller, the deal is very simple: the capital provider loans a set amount. The receiver undertakes to repay that set amount with set interest. At least mostly.

Like everything in finance, this simple premise gets very complicated, very quickly. And ironically, I think that actually boosts the truth-teller quality of the bond market. Because it is hard to understand, and ordinary investors are more attracted to the higher returns of the stock market, it does its own thing unencumbered.

So, obviously, I’m simplifying here. Bond markets can and have been distorted by central bank intervention (QE, yield curve control, rate caps) or forced buying (pension funds, banks, insurance companies that must hold bonds). In places with capital controls or heavy government intervention, like China or Turkey, at times, yields may not reflect real risk because the state distorts the market. All the attempts by developing countries to originate new rating agencies are really just a way of trying to bend the market to their preference.

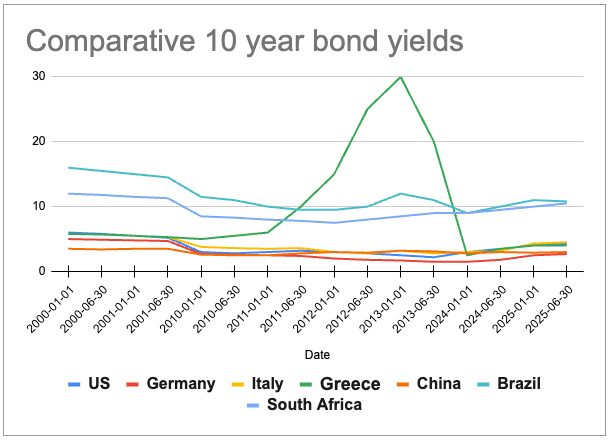

It can also be spectacularly wrong. Before 2008, Greece could borrow almost as cheaply as Germany, because markets believed eurozone members were equally safe. But when Greece’s hidden deficits were exposed in 2009–2010, investors panicked about whether Greece could repay its debt without defaulting or leaving the euro. Greek ten-year bond yields soared — from about 5% in 2009 to over 30% by 2012. That spike meant bondholders demanded massive extra compensation for the risk that Greece might default or restructure its debt.

But that never happened, and Greek bond yields came crashing down, rather like its government at the time.

Where am I going with all this? Here is the truth, and it's truth because it's spoken by the global bond markets. American bonds are more expensive than Greek bonds. Simple. But true.

So, to all those who are tempted to believe that US President Donald Trump is doing the right thing, negotiating hard and sorting out the world, you are absolutely entitled to your truth. Stock markets are at record levels. The "big beautiful bill" has been passed. There may be a peace deal in Palestine.

But know this: the modern equivalent of the Oracle of Delphi has spoken.

The bond market may be wrong; it has been before.

But not often. 💥

From the department of unusual emigres ...

From the department of complaints, besides the quality of the coffee ...

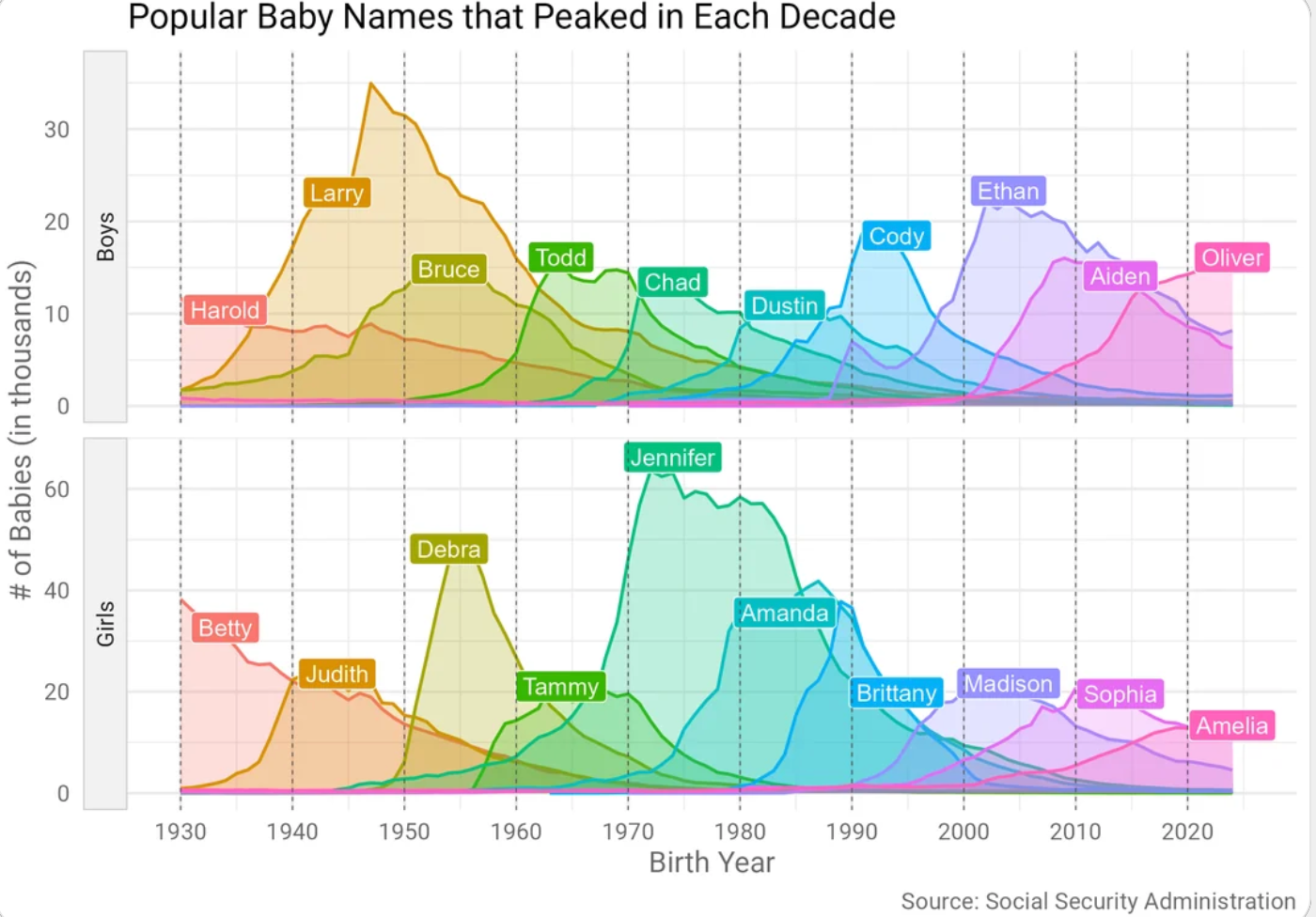

From the department of Amelia! Really?

Thanks for reading - please do share if you have a friend (or enemy!) you think would value this blog and ask them to add their email in the block below - it's free for the time being. If the sign-up link doesn't appear, you'll find it on the site.

Till next time. 💥

Join the conversation